This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

Across the entire roughly $4.49 billion reinsurance risk transfer tower of Florida’s Citizens Property Insurance Corporation the capital markets have taken their largest share proportionally in 2025, with around 87% of the total backed by catastrophe bonds, collateralized reinsurance markets and ILS fund managers.

As Artemis was first to report yesterday, Florida Citizens confirmed the successful completion of its reinsurance renewal for the 2025 hurricane season, securing the targeted traditional and catastrophe bond coverage for less than the budget that had been set.

As Artemis was first to report yesterday, Florida Citizens confirmed the successful completion of its reinsurance renewal for the 2025 hurricane season, securing the targeted traditional and catastrophe bond coverage for less than the budget that had been set.

For 2025, Florida Citizens had a target to secure $4.49 billion of total risk transfer, across cat bonds and reinsurance, with $2.89 billion of new reinsurance and/or cat bonds required, alongside the $1.6 billion of still in-force cat bond deals from prior years.

Having secured significant catastrophe bond coverage with the $1.525 billion Everglades Re II Ltd. (Series 2025-1) issuance in May, it meant $1.369 billion of newly placed risk transfer was secured in reinsurance form, from both traditional and some collateralized markets.

Now, Artemis has seen details of the breakdown of lines within the $1.369 billion of traditional reinsurance that Florida Citizens secured at the renewal and, as usual, it features meaningful additional capacity backed by capital markets investors.

The catastrophe bond market is providing $3.125 billion of reinsurance limit to support Florida Citizens for the hurricane season in 2025, which puts the insurer third in our cat bond sponsor leaderboard at this time.

But, of the $1.369 billion of traditional reinsurance limit secured at the renewal, at least 59% has been provided by collateralized markets and insurance-linked securities (ILS) fund managers.

Reinsurance companies appear to have taken almost $566 million of the Citizens placement for 2025, although it’s important to note there are names in the list that may have ceded some of that risk to their own capital market vehicles, such as Everest, PartnerRe, Ascot, Ariel Re and others.

Which means the actual proportion of the Florida Citizens traditional reinsurance placement backed by capital market investors could be higher still than the 59% we can definitely identify as collateralized or ILS backed.

Before we go into who participated on the collateralized and ILS manager side of things, let’s deal with the top-level breakdown of the Citizens tower first.

As we said, some 59% of the traditional side of Citizens reinsurance renewal has been provided by collateralized and ILS markets, with perhaps some more coming through reinsurers risk-sharing vehicles as well, albeit the latter not being identifiable.

That 59% is actually slightly down on last year’s 66% of the Florida Citizens reinsurance placement that was taken by collateralized and ILS markets.

But, with the catastrophe bond component having grown, the share taken by overall capital markets backed capacity has now increased further, from the 81% seen last year, to now 87% of the entire Florida Citizens risk transfer tower being backed by either catastrophe bonds, fully-collateralized reinsurance markets, or ILS fund managers.

That drives home the importance of the ILS market for insurers with significant property catastrophe exposure in 2025, as well as the fact ILS backed capacity has proven very efficient this year.

Looking into the final lines across the Florida Citizens property catastrophe excess of loss reinsurance layers that were placed at the mid-year 2025 renewals, many of the typical names we’ve seen in previous years continue to feature.

At just over $360 million, the largest of the capital markets backed participants in Citizens reinsurance placement was ILS manager Nephila Capital, with $10 million secured through its Lloyd’s syndicate 2357 and $350 million through Markel Bermuda, all sourced via Nephila’s Nautical Management Ltd. entity.

In fact, Nephila Capital is again the largest line in the Citizens program, far bigger than any of the traditional reinsurers that participated.

After Nephila, on the collateralized and ILS side, is Aeolus Capital Management, which took just over $155 million spread across two segregated accounts of its Keystone strategy, as well as some limit placed via Hannover Re fronting.

The next largest participant at Citizens reinsurance renewal was hedge fund D. E. Shaw who took almost $139 million of the tower, all underwritten through cells of D. E. Shaw Re in Bermuda.

Bermuda based ILS fund manager Pillar Capital Management took almost $66 million of the placement, also written on paper provided by global reinsurance firm Hannover Re.

LGT ILS Partners was next, underwriting almost $31.5 million of the tower via its rated reinsurer Lumen Re in Bermuda.

Alternative investment manager Quantedge Capital took an almost $21.2 million share via two lines written with fronting support from Arch Re and Hannover Re.

Investor One William Street Capital took a $15 million line fronted by a cell of Artex’s Axcell Re structure.

ILS manager Leadenhall Capital Partners took a nearly $14.5 million reinsurance line, fronted via its relationship with reinsurer Nectaris Re Ltd.

Lastly, Eskatos Capital Management took an almost $1.14 million line, fronted on Hannover Re paper.

The only ILS type market missing this year, that participated in 2024, is Stone Ridge Asset Management.

The majority of participations in the tower are down year-on-year, except for LGT ILS Partners, Quantedge and One William Street Capital, all of who took a slightly larger line in 2025.

The collateralized, cat bond and ILS manager markets have stepped up their support of Florida Citizens, in proportional terms of their share of the overall risk transfer and reinsurance program in 2025, clearly demonstrating that Citizens felt the capital markets offered real value this year leading it to place more of its renewal needs with ILS style capacity.

Other notable participants, from the traditional side of the reinsurance market, include Swiss Re taking a $94 million line, Everest Re $86.5 million, Odyssey Re taking $71.2 million, Munich Re taking $67.9 million, Ariel Re taking $62.3 million, TransRe taking $73.9 million, PartnerRe just over $52.7 million, Ascot close to $20 million and MAP syndicate just over $17 million.

A number of these have dedicated third-party capital partnership vehicles and structures, or have specific backing from other semi-independent ILS fund managers, so as we said we suspect more of the risk will ultimately end up backed by the capital markets from the Florida Citizens reinsurance tower for 2025.

But, even without that information, the key role cat bond, ILS and collateralized markets play for Citizens, for Florida and for peak zone natural catastrophe peril reinsurance is driven home by the significant percentage of this overall risk transfer tower that resides in the capital markets, rather than on traditional reinsurance balance-sheets.

Read about every one of Florida Citizens catastrophe bonds in our extensive Deal Directory.

Read all of our reinsurance renewal news coverage.

Cat bonds, collateralized and ILS managers took 87% of Florida Citizens tower in 2025 was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.

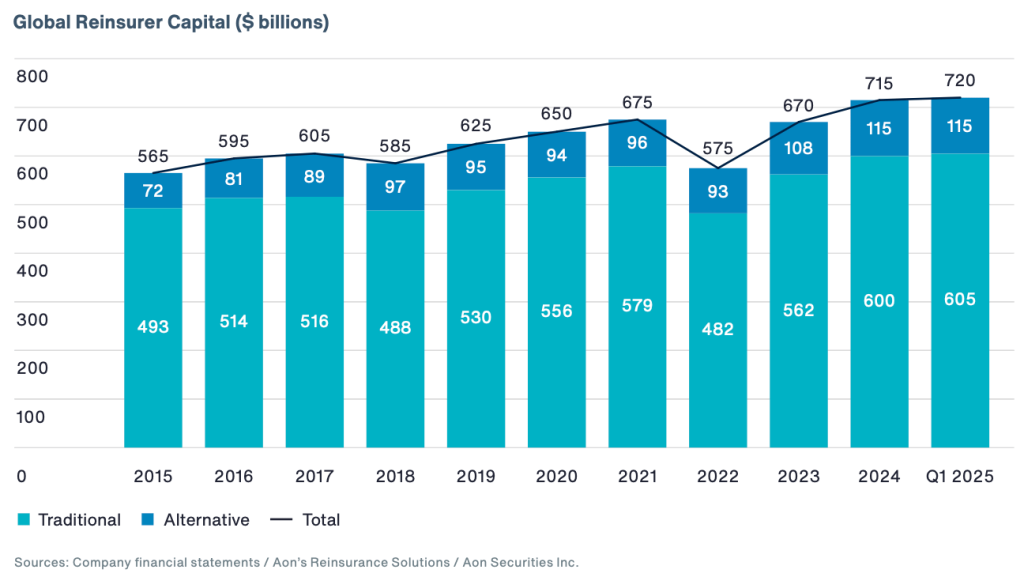

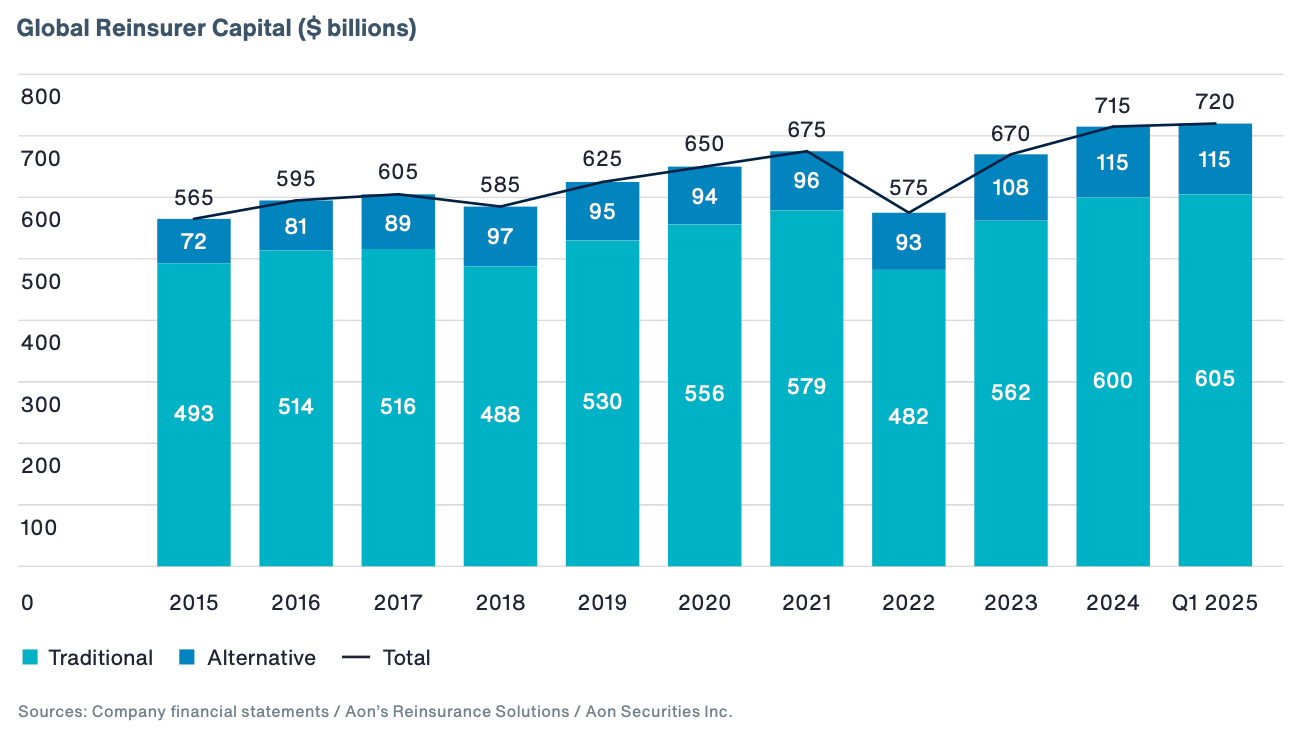

Commenting on the property catastrophe reinsurance market after the mid-year 2025 renewals, the Jefferies equity analyst team highlight the influx of capital that helped to moderate pricing and make renewal outcomes more favourable for buyers.

Commenting on the property catastrophe reinsurance market after the mid-year 2025 renewals, the Jefferies equity analyst team highlight the influx of capital that helped to moderate pricing and make renewal outcomes more favourable for buyers.